ESG in Canada 2026: What Companies Must Prepare for

ESG in Canada: The 2026 Landscape In 2026, ESG in Canada moves from strategy to execution. Even without a single national climate rule, expectations continue to rise. Investors, banks, insurers, and major buyers now expect structured and comparable sustainability information that supports financial decisions. The Canadian Sustainability Standards Board finalized the Canadian Sustainability Disclosure Standards (CSDS […]

How to Implement CSRD and ESRS as a Sustainability Consultant

The Corporate Sustainability Reporting Directive (CSRD) is reshaping the sustainability consulting market across Europe. From 2024 onward, thousands of companies must comply with mandatory sustainability reporting under the European Sustainability Reporting Standards (ESRS). As a result, demand for qualified sustainability consultants and trainers is rising fast. Organizations now need expert support to implement CSRD, conduct […]

Why ESG Consultants Need a Growth Playbook Now

The ESG consulting market has changed materially over the last two years. A structured ESG consulting growth playbook is no longer optional. It is now a prerequisite for scaling with confidence. What once revolved around broad sustainability advice and high-level frameworks has now shifted toward regulatory precision, documented methodologies, and auditable results. Today, clients expect […]

California SB-253 and materiality expectations in the U.S.

Why California SB-253 Is Changing U.S. Materiality Expectations California SB-253 materiality expectations are redefining how companies approach climate disclosure in the United States. The law requires large companies that do business in California to report greenhouse gas emissions on a phased timeline starting in 2026.According to ESG News, SB-253 moves climate reporting from a voluntary […]

The Role of Green Technology in Achieving U.S. Sustainability Goals

Green technology U.S. sustainability goals now depend on something practical: better data and smarter tools. U.S. companies need solutions that measure emissions accurately, reduce waste, and improve supply chain transparency. At the same time, stakeholders expect proof, not promises. That is why carbon measurement platforms, Scope 3 data tools, and ESG reporting systems are becoming […]

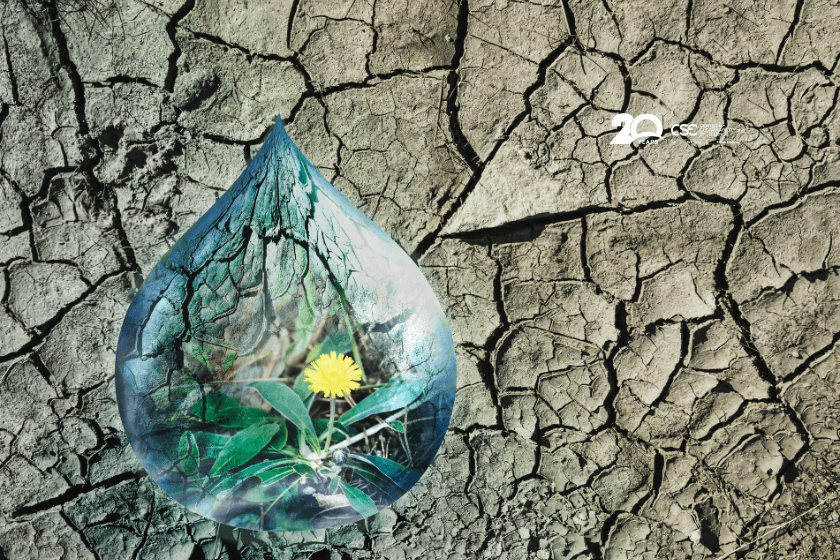

Water Bankruptcy and Business Risk

Water is no longer just a sustainability issue. It has become a direct business risk. Across industries, companies are facing an uncomfortable reality: in many regions, water systems cannot keep up with demand. This growing pressure is now being described as “water bankruptcy,” and it is already affecting operations, supply chains, and cost stability. At […]

What Skills Drive Sustainability Careers in Canada? Part 2

From Job Growth to Skill Demand Sustainability jobs are growing across Canada. However, skills now define who succeeds. According to CSE Annual Research in Sustainability 2026, Canadian employers increasingly hire for applied sustainability capabilities, not general awareness. This shift explains why some professionals advance quickly while others struggle to enter the field. How Canadian Employers […]

ESG Ratings and Profitability in Canada

What 2024 vs 2025 Data Really Shows For years, sustainability professionals have debated whether ESG performance genuinely supports financial success. Is ESG a cost, a compliance burden, or a driver of long-term profitability? CSE’s Sustainability Leaders 2026 Annual Research offers one of the clearest answers to date. By analyzing 210 of the most profitable companies, […]

What Skills Power US Sustainability Careers? Part 2

From Job Growth to Skill Demand In Part 1, we explored why sustainability jobs are expanding across the United States. Growth alone, however, does not define the future of work. Skills do. According to CSE Annual Research in Sustainability 2026, US employers are no longer hiring sustainability professionals based on environmental awareness alone. They want […]

Breaking Down the Business Case for CSRD and ESRS in the U.S. (2026)

If your company sells into Europe, owns EU operations, or funds growth with global capital, EU sustainability disclosure rules can quickly become your “new normal.” Even if your headquarters sits in the United States, your customers, lenders, and business partners may ask for CSRD aligned reporting supported by ESRS disclosures. And in 2026, that request […]